Viewpoints

Expert takes and informed perspectives.

Here you’ll find recurring and one-time local commentary on Hawai‘i’s most pressing community and policy issues. We seek out in-depth analysis, solution-driven views and special expertise. If there’s something on your mind that you’re an expert on, email the editor at kam@alohastatedaily.com for consideration.

Community Voices: Your money stays in Vegas — then the IRS wants some

A trip to Hawai‘i's Ninth Island could have tax ramifications, if you're writing off gambling losses to offset gambling gains. Here's how the One Big Beautiful Bill Act is changing those equations, and a look at what the State of Hawai‘i will have to consider regarding its own gambling taxes.

Tom YamachikaSeptember 23, 2025

Community Voices: Hawaiʻi Legislature sued over ‘blank’ bills

The League of Women Voters of Hawaiʻi contends that this practice of passing a measure with boilerplate language is unconstitutional. Learn also what lawmakers claim.

Keliʻi Akina & Ph.D.September 16, 2025

Community Voices: Charitable giving under the One Big Beautiful Bill Act

Hawai‘i's nonprofits rely on charitable contributions from generous individuals. Here's what you need to know about the new tax rules for writing off these donations on your taxes.

Tom YamachikaSeptember 14, 2025

Community Voices: Kudos to the counties for considering housing reforms

Maui and Hawai‘i counties are both looking into ways to make housing more plentiful.

Keliʻi Akina & Ph.D.September 10, 2025

Community Voices: Time to retire the Jones Act’s U.S.-build requirement

The Jones Act was supposed to protect the American shipbuilding industry, but the industry has withered away despite that support. New legislation by U.S. Rep. Ed Case of Hawai‘i proposes changes to the act that could ultimately reduce shipping costs to the Islands.

Keliʻi Akina & Ph.D.September 03, 2025

Community Voices: No tax on tips

A closer look at what "no tax on tips" in the federal One Big Beautiful Bill Act means for Hawai‘i's workers and employers.

Tom YamachikaSeptember 02, 2025

Community Voices: Are you ready for another boondoggle?

Sen. Joni Ernst of Iowa has a history of rightfully targeting Honolulu’s rail project for its wasteful spending. Which brings us to the planned Aloha Stadium project...

Keliʻi Akina & Ph.D.August 26, 2025

Community Voices: Classroom heat

The Department of Education spent $100 million on classroom air conditioners. Now the Hawai‘i State Auditor finds that the DOE has no idea where the money went.

Tom YamachikaAugust 25, 2025

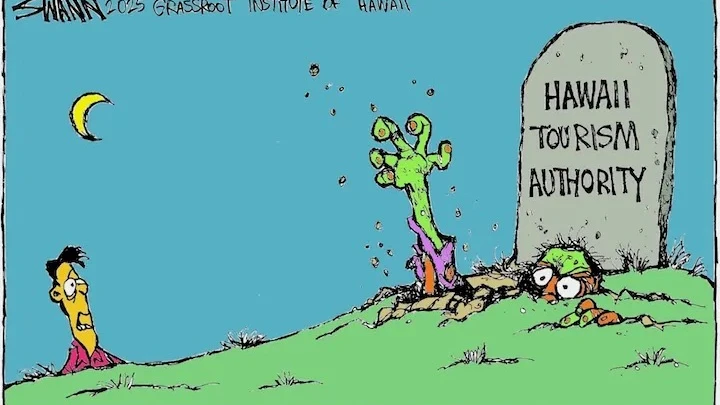

Community Voices: ‘New’ HTA board taking off with same old baggage

A government entity tasked with both promoting and limiting tourism is always going to be compromised.

Keliʻi Akina & Ph.D.August 22, 2025

Community Voices: Remembering a life steeped in peace

Dr. Genshitsu Sen, a former WWII kamikaze pilot trainee who turned to the Way of Tea, practicing harmony, respect, purity and more, died last week at age 102. Since the early 1950s, he had deep ties to Hawai'i, including spending time with University of Hawai'i at Mānoa's faculty and students.

Justin PetersonAugust 21, 2025

Community Voices: No tax on overtime

Here's what the "no tax on overtime" provisions of the One Big Beautiful Bill Act will mean for your pocketbook.

Tom YamachikaAugust 18, 2025

Two years later, too little rebuilding in Lahaina

Hereʻs how federal, state and county policymakers could go about speeding up the process for displaced residents and business owners.

Keliʻi Akina & Ph.D.August 12, 2025